fjrigjwwe9r3SDArtiMast:ArtiCont

Mutual funds are versatile tools that can be put to many uses such as generating emergency funds and retirement income

Very often, we think we don’t need mutual funds in our portfolio and that our existing investments are enough to meet our future goals. But, to reach our goals we need a vehicle. We’re not saying mutual funds are the only vehicle for reaching your goals, but they are certainly one of them. Mint spoke to a few financial planners to understand the role mutual funds played in the lives of their clients.

Emergency corpus

Long-term goals are important, but how do we cover unexpected calamities? Enter an emergency corpus, which can take care of sudden expenses that we couldn’t have planned for. This corpus came to the rescue of a Delhi-based lawyer who had walked into Gurugram-based financial adviser Ashish Chadha’s office in 2009. In those days, she and her husband were sceptical about investing in mutual funds. After much persuasion, Chadha got them to invest Rs1 lakh in a mix of fixed income funds, of which 50% went into a liquid fund for emergencies. “Around 2011, they needed Rs4 lakh for her mother’s hospitalization. We redeemed the money instantly from their liquid fund investments,” recollects Chadha.

Building an emergency corpus is not tough. By investing Rs5,000 a month in a liquid fund for 36 months, which earns 6% a year, you can have an emergency kitty of about Rs5.95 lakh, which can cover hospitalization expenses for most ailments. Financial planners suggest a corpus equivalent to 6 months of expenses.

And why a liquid fund? “First, this money will not show in your savings account, so it would not encourage impulsive spending behaviour. Second, you can withdraw it easily. A liquid fund also enables you to invest through a systematic investment plan as opposed to buying a new fixed deposit every month, which you will have to if you use the fixed deposit route to build an emergency corpus,” says Balvir Chawla, director, Finnovators Solutions Pvt. Ltd, a Pune-based financial planning firm.

Windfall gains

When salaried employees get a bonus or when someone inherits a large amount, what to do with it? Finding a vehicle to invest this money is crucial, else it could get spent.

Bengaluru-based financial adviser Mrin Agarwal conducts Womantra: financial literacy workshops for women. She used to come across many people who had earned—and encashed—employee stock option plans (ESOPs) and were sitting on a pile of cash.

“These were typical middle-class employees in the information technology sector, for whom capital preservation is important. I had advised debt funds to them to earn better and tax-efficient returns compared to fixed deposits,” says Agarwal.

Windfall gains, ideally, must be invested for the long run. And you don’t need to invest them in equity funds only; debt funds work just as well if that’s what your asset allocation demands. Also, remember that bank fixed deposits are taxed at your income tax slab rate. While withdrawals from debt funds before 3 years are also taxed at your income tax rates, after 3 years the withdrawals are taxed at 20.60% with indexation benefits.

Funding down payments

Many of us want a house of our own. A combination of reasonable income and a housing loan can help you to pay your equated monthly instalments (EMIs). But what about the down payment, which is a lump sum that you need to pay while booking your house? Enter mutual funds again. Say you want a home loan of Rs50 lakh in the next 5 years and need to have Rs10 lakh as down payment. Now, if you invest in a debt fund that return 8% a year, you would need to invest close to Rs14,000 a month for the next 5 years. “Most people do not save in a structured manner for the down payment of a house. We have seen youngsters breaking their Employees’ Provident Fund (EPFO) kitty for down payments, something that we tell them to avoid. We suggest investing in ultra short-term or short-term debt funds regularly to build the corpus for down payment rather than redeeming their EPFO money,” says Agarwal.

Funding your goals

We all have dreams and financial goals. But how to realise them is always a big question. What if you want to send your child to a premier college for postgraduation, like an Indian Institute of Management (IIM)? At present, the fees for a 2-year postgraduate programme at IIM-Ahmadabad is around Rs19.50 lakh. Assuming you are planning for a newborn and she would seek admission after 21 years—we can safely assume the fees to be around Rs66.29 lakh then, assuming a 6% inflation. This means, if you have an equity mutual fund that grows at 15% compounded, you would need to invest around Rs4,000 a month to reach the goal.

Chadha saw this first hand. In 1998, he made one of his clients, a Delhi-based couple, start an SIP of Rs1,000 to fund their children’s higher education. The parents wanted to invest in real estate but Chadha persisted. In 2005, on the back of rising equity markets, when the couple saw the money grow they increased the commitment to Rs10,000 a month. “Two years ago, their daughter went to Oxford University to study law. Now convinced, the daughter too has started her own SIP,” says Chadha.

Income after retirement

Retirement may be bliss for some but most people dread it because it means that their regular income has stopped but expenses would only increase, thanks to inflation. So, how do we earn regular income from mutual funds?

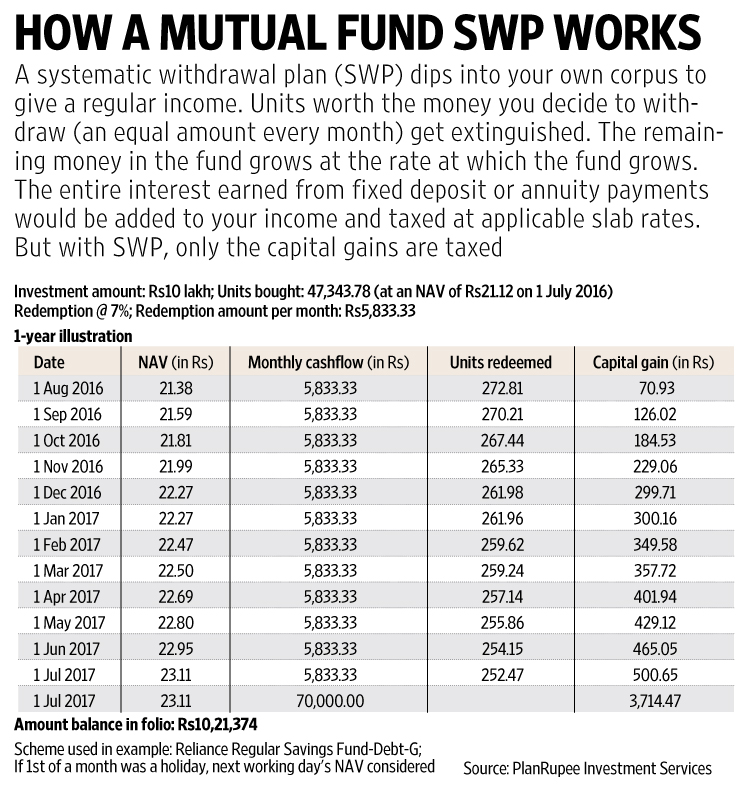

Amol Joshi, founder, PlanRupee Investment Services suggests systematic withdrawal plans (SWPs). An SWP is the opposite of a SIP and all fund houses offer this facility in most of their schemes. Here, you withdraw a fixed sum of money every month. Your fund house extinguishes units at the prevailing net asset value and pays you a fixed sum (see table).

Although equity funds also offer SWPs, Joshi recommends that you do them through debt funds to limit the effects of volatility. Since an SWP withdraws a fixed sum every month, the danger here is that it could eat into your capital if the equity market keeps going down for a prolonged period and you don’t stop the SWP.

If you have a lump sum around the time that you retire and you want to earn a regular income out of it while allowing the rest of it to grow, Joshi suggests a strategy. He advises splitting the corpus between liquid or ultra short-term bond funds and short-term debt funds. “Your monthly income requirement for the first 2 years should come out of your liquid fund or ultra short-term bond fund’s SWP. For your monthly income requirements starting from the third year, start an SWP in your short-term fund investment then,” he says.

Mint Money take

These are real-life problems that we all could face, for which we need solutions. A mutual fund is one of few vehicles that offer help here. But it’s not a magic wand. You need to figure out your asset allocation and your risk appetite first and be realistic about your financial goals.

![]() 9840018033

9840018033![]() 9840018033

9840018033