fjrigjwwe9r3SDArtiMast:ArtiCont

fiogf49gjkf0d

From 1 January, it has become mandatory for all credit information bureaus to give one free credit report once in a financial year to every individual who asks for it. All companies had put in place systems to do so. However, there were a few problems. All the companies had different processes and as Mint found out, the processes were not always smooth.

Now, magically, a month after our story, the process of getting a free credit report has become much smoother. But before describing the updated processes, here is a short background on what the issue is all about and some basics regarding credit reports and credit scores.

The Reserve Bank of India (RBI) has made it mandatory for all credit information bureaus in the country to provide a full credit report, on demand and without any charge, to individuals whose credit history is available with them.

At present, there are four such companies in India: CRIF High Mark Credit Information Services Pvt. Ltd, Equifax Credit Information Services Pvt. Ltd, Experian Credit Information Co. of India Pvt. Ltd and Transunion Cibil Ltd.

As you can avail one free report from each bureau , this means that you can get four free reports every year.

A credit information report (CIR) contains details of your credit history, as collated by a credit information company. Whenever you apply for a loan, the lender contacts a credit bureau to check your credit background to know details such as, whether you have paid earlier dues on time. This information reflects your monthly payments and how you manage your credit. It forms a part of your overall credit history, and will reflect in your CIR. Based on the information, the bureau assigns a score.

A CIR also helps individuals to check their eligibility for a loan.

Free report

The central bank has asked credit rating companies to put the process of accessing a free report on their respective websites, which the companies have done. However, as reported earlier, the process and time taken to get a free report varies for each of them. Let us take a look at the process once again and see how it has been simplified.

CRIF High Mark: As pointed out in our previous story, we got the report from it in about 7 days. The company, in an email response, said that the CRIF report “actually becomes available to most consumers within 48 hours.” Many have also received their reports within a day, it said.

The process requires online authentication. However, if a consumer fails to authenticate herself online, she can send scanned copies of the Know Your Customer (KYC) documents such as Permanent Account Number (PAN), passport and recent electricity bill for back-end teams to verify the consumer before releasing the report, the bureau said.

Equifax: To get the Equifax report, you have to download its mobile application, which is available for Android and iOS devices. From the app, along with the basic KYC details, you also have to share your Aadhaar number to get the free report.

The bureau said in an email response that individuals who don’t have a smartphone or Aadhaar can get a report by sending scanned copies of KYC documents to the bureau in an email along with a form. While the app-based method of this bureau is smooth, and the report was delivered in 2 days, the time taken to get a report after sending the application through email is not very clear.

Experian: To get a free Experian report, the company has created a process where you have to use a voucher code at the payment page, instead of paying a fee. It takes up to 48 hours to get the voucher after you place the initial request on the company’s website at www.experian.in/consumer/experian-free-credit-report.html.

Once you receive the voucher code, you can get the report in a few steps in a single session. The instructions are shared along with the code. After entering the voucher code, you will be asked to answer a few questions based on your credit history. We could not get an Experian report in our initial attempts, but recently we did get one. It took 3 days to get the report.

Transunion Cibil: To get a free report from Cibil, earlier you needed to submit a paper-based request form to the company along with KYC documents. The company has now put in place an online system at www.cibil.com/freecreditscore.

Consumers who fail the online authentication can still submit the KYC documents through snail mail. It would take 7 working days to verify the documents and dispatch the login credentials to the consumer for accessing her free Cibil score and report on the myCIBIL portal, the company said.

We tried getting the free report from Cibil and it took about 5-10 minutes in a single session to get the report online. Before you attempt that, make sure you have your credit-related information like credit card or loan details to authenticate yourself.

Credit score demystified

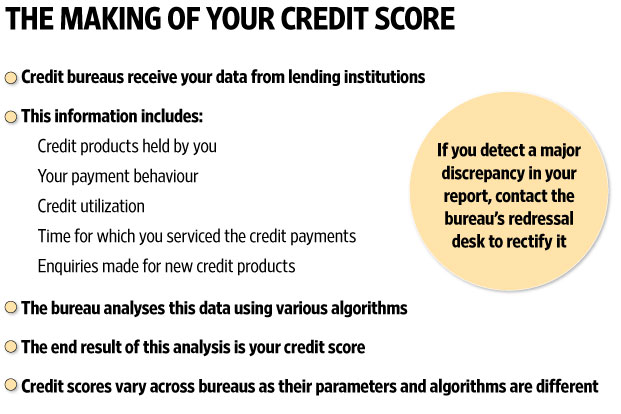

All credit bureaus in India assign a score in the range of 300 to 900. All the bureaus have their own proprietary scoring models to arrive at a credit score. The credit bureaus get the data to analyse from all lending institutions. Typically, information related to types and amount of credit products held by the borrower, payment behaviour on these credit products, credit utilization, amount of time for which the borrower has serviced credit payments and enquiries made for new credit products is analysed to reach a score. However, there are chances that your score could vary from one bureau to another. This could happen because different bureaus have different algorithms and different levels of filters for the data in their credit database. So, if you have different scores from different bureaus, it is not a cause of concern. But do take a look at the data related to your credit history in the report and flag with the redressal desks of credit bureaus if you find any discrepancies.

![]() 9840018033

9840018033![]() 9840018033

9840018033